As Covid-19 came knocking in Kenya, many Kenyans were found unaware. Their business shut and millions were rendered jobless. Banks refrained from lending to individuals and mobile loan apps were closing shop due to restrictions.

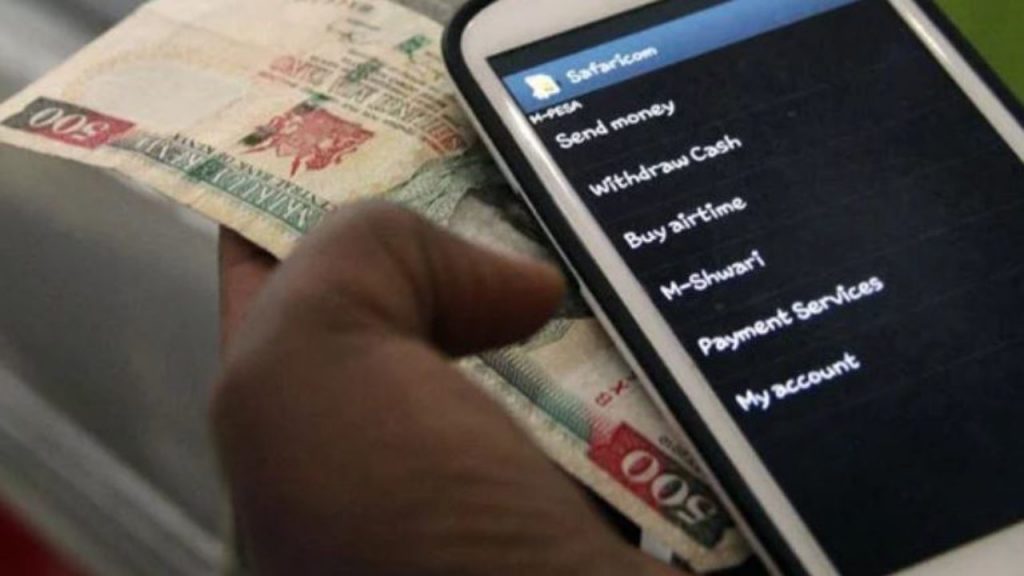

The only hope was Fuliza, an overdraft facility from telecommunications giant, Safaricom. Kenyans seem to have turned to Fuliza en masse, currently borrowing an average of 830 million shillings per day from Fuliza according to the recently released stats.

In six months to September 2020, Safaricom customers took 149.4 billion shillings from Fuliza, an increase from 112.2 billion shillings a year earlier, indicating a daily borrowing of 830 million shillings per day.

Fuliza is recovered directly from an M-Pesa wallet as soon as the subscriber tops up. This means it is not easy for a subscriber to default on paying Fuliza as long as he/she is using the same line to send and receive cash.

On the other hand, the update of M-Shwari loans dropped by 14.3 percent to 47.5 billion shillings, showing the effect of stringent measures employed by Safaricomin giving out M-Shwari loans that have registered increased defaults.

The increased use of Fuliza earned Safaricom 2.15 billion shillings as revenue, representing a 60.7 percent increase on the 1.34 billion shillings it earned the previous year.

Subscribers who do not settle their Fuliza overdrafts within 30 days are barred from using their unused credit limit until they pay the outstanding amount.

On Monday, Safaricom announced its half-year financial results with its profits dropping by six percent to 33 billion shillings compared to a similar period in 2019.

Safaricom’s CEO Mr. Peter Ndegwa attributed the drop in profits to the decision by the Central Bank of Kenya to zero-rate M-Pesa transactions for amount 1,000 shillings and below. M-Pesa on a year-to-year declined by 14.5 percent.

In the first six months of this year, M-Pea brought in 35.9 billion shillings to Safaricom, a drop from 42 billion shillings recorded in 2019. Safaricom CEO Peter Ndegwa says the performance was good given the tough operating environment.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]