Cytonn Real estate says average rental yields softened across all sectors in Kenya according to a report by Cytonn, coming in at 7.4, 7.3 and 5.1 percent, for retail, office, and residential sectors, respectively, from 7.7, 7.8 and 5.2 percent in Q1’2020.

The land sector recorded an overall annualized capital appreciation of 1.4 percent, with asking land prices in low rise residential areas recording the highest annual growth at 3.8% driven by the increased demand for affordable land.

This is according to a report by Cytonn Real Estate, the development arm of Cytonn Investments, which has released its H1’2020 Markets Review. The report highlights the current state of the real estate sector in terms of uptake, rental yields, capital appreciation, and hence, total investor returns.

Further, according to the report, constrained financing, supply chain constraints, and reduced revenues arising from slow market uptake and downward pressure on prices and rents due to the ongoing COVID-19 pandemic are expected to remain as the main challenges facing the real estate sector.

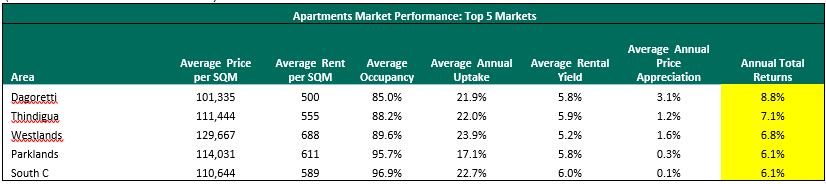

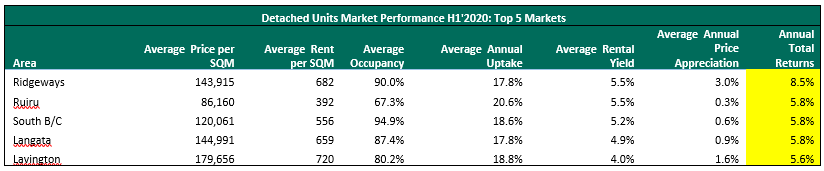

“The residential sector remained relatively stable with most sectors softening in performance, albeit marginally. Dagoretti, Ridgeways and Westlands recorded the highest annual price appreciation at 3.1%, 3.0% and 1.6%, respectively”, said Wacu Mbugua, Research Analyst at Cytonn.

In commercial real estate, Gigiri, Karen and Westlands were the best performing office nodes in H1’2020 recording rental yields of 8.9%, 8.3%, and, 8.2%, respectively due to their superior locations and availability of top-quality offices, enabling them to charge a premium on rental prices, while in the retail sector, Westlands and Karen were the best performing retail nodes with average rental yields of 9.8% and 9.2%.

“Of the six sectors, our outlook is positive for one – land; neutral for three – residential, retail and hospitality; and negative for two – office and listed real estate. Thus, our outlook for the real estate sector remains neutral. Going forward, we expect the industrial sector, residential, land, and select office markets to continue holding up well in terms of performance, while retail and hospitality remain the most affected. The sector’s performance should improve significantly towards the end of 2020 once economic activity regains momentum,” added the report.

Hospitality

The hospitality sector was significantly affected by the COVID- 19 pandemic which led to a slowdown of operations following the cancelling of meetings, conferences and events, the banning of all international flights and reduced local direct flights. However, we expect the sector’s recovery to commence in the near term on the back of government policies such as the budget allocation towards tourism marketing and support for hotel refurbishment through soft loans.

The detached units’ market recorded an average annual price appreciation of 0.3% compared to the apartment market’s (0.2%) attributable to less supply of standalone units coupled by growing demand by home buyers.

The I-REFT continued to perform poorly during the period with the once per share dropping to tows of Ksh5.5, the lowest since the I-REIrs inception in 2015 .

“We expect listed real estate to continue performing poorly attributed to continued lack of investor interest in the instruments and the continued subdued performance of the real estate sector as IT continues to grapple with the effects of the COVID-19 pandemic,” added the report.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]