Kenya’s banking sector has undergone a remarkable transformation, with digital banks rising to prominence.

These digital-first institutions are offering services that make financial management easier, more accessible, and more efficient than ever before.

Among them, Co-operative Bank of Kenya (Co-op Bank) has distinguished itself as a leader in providing secure, innovative, and user-friendly banking services to both individuals and businesses.

Let me take you through the top 6 digital banks in Kenya and explain why Co-op Bank stands out as a top choice.

1. Co-operative Bank of Kenya (Co-op Bank)

Co-op Bank is a trailblazer in Kenya’s digital banking space. Known for its strong customer service and comprehensive digital banking services, Co-op Bank has managed to balance cutting-edge technology with personalized banking experiences.

Why Co-op Bank is Better

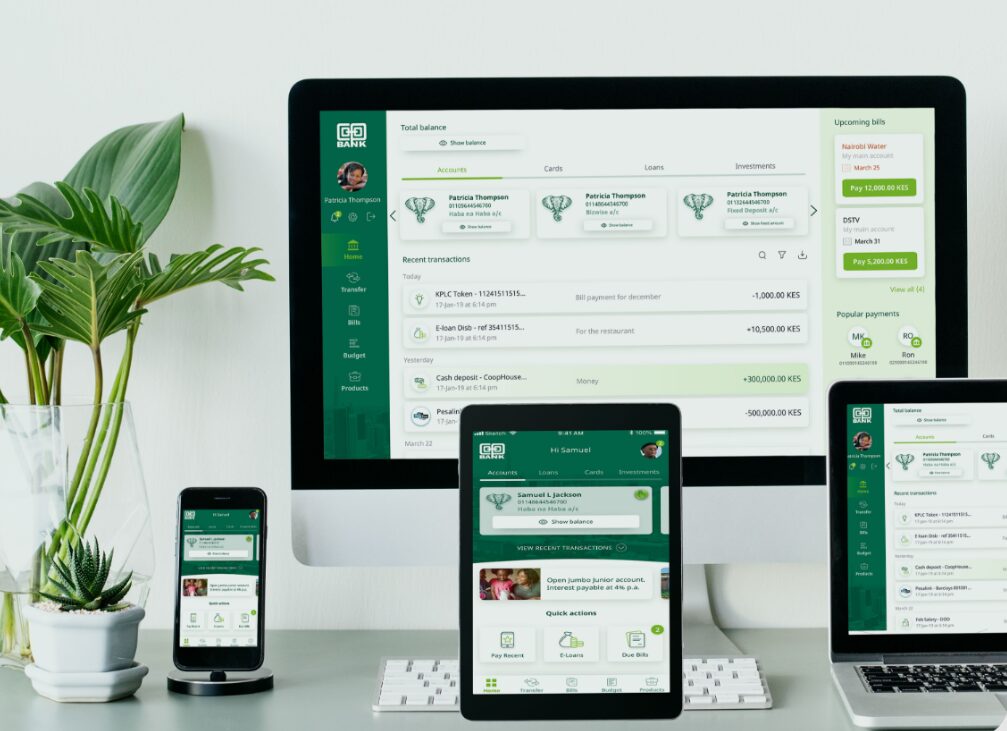

Comprehensive Digital Services: Co-op Bank offers an impressive suite of digital banking options, including mobile banking through the Co-op Mobi App, internet banking, and a robust USSD service (*667#). Whether you’re on the go, at home, or in an area with limited access to internet services, Co-op Bank’s digital solutions cater to all.

Security: The bank employs top-tier encryption and multi-factor authentication, ensuring your financial transactions are protected. It is also known for its proactive fraud monitoring systems, giving customers peace of mind.

User-Friendly Interface: Co-op Bank’s mobile and internet banking platforms are intuitive and easy to navigate, allowing users of all ages to manage their finances effortlessly.

Business Solutions: In addition to personal banking, Co-op Bank also offers digital banking services tailored for businesses, including solutions for e-commerce, trade finance, and loans.

With its well-rounded offerings, Co-op Bank remains a top contender in Kenya’s digital banking sector, making it a preferred choice for many.

2. M-Pesa

M-Pesa revolutionized mobile banking in Kenya and remains one of the most widely used platforms for mobile money transfers. It allows users to send and receive money, pay bills, and buy goods through their mobile phones.

M-Pesa Features

Mobile Money Transfers: Quick and secure transfers for both local and international payments.

Bill Payments & Loans: M-Pesa also provides services for paying bills and applying for mobile microloans.

While M-Pesa has made a significant impact on financial inclusion, it does not provide the same range of comprehensive banking features as Co-op Bank, particularly in areas such as business banking and e-commerce.

3. KCB Mobi

KCB Mobi is another popular mobile banking solution in Kenya. It offers a range of services including money transfers, bill payments, and loan management.

KCB Mobi Features

Loan Access: Instant access to mobile loans and the ability to manage loan repayments.

Bill Payments and Transfers: Easily pay bills and transfer money via the app.

Although KCB Mobi is efficient, its offerings are not as extensive as Co-op Bank’s, especially in terms of e-commerce solutions and the advanced security protocols it offers.

4. Equity Eazzy Banking

Equity Bank’s digital banking platform, Equity Eazzy Banking, is designed to simplify banking for individuals and businesses. It offers mobile banking services, bill payments, and loan management.

Equity Eazzy Features

Mobile Banking: Easy access to banking services on the go.

Loans & Bill Payments: Apply for loans and settle bills seamlessly through the app.

While Equity’s mobile platform is user-friendly, Co-op Bank’s range of business banking services, advanced security features and superior customer support make it a more complete solution for both individuals and businesses.

5. NCBA Loop

NCBA Loop offers a digital banking solution that caters to personal finance needs, providing features like personal loans, overdrafts, and budgeting tools.

NCBA Loop Features

Quick Loan Access: Offers personal loans up to Ksh 3 million.

Budgeting Tools: Helps users track their spending and manage finances.

While Loop is great for individual consumers, it does not offer the same level of business support as Co-op Bank, particularly when it comes to trade finance and other corporate banking services.

6. Standard Chartered Bank (SCBK)

Standard Chartered Bank has also embraced digital banking with its platform that offers mobile banking services, bill payments, and loan management.

SCBK Features

Mobile Banking: Manage accounts and transfer funds using the app.

Loans and Payments: Offers loans and the ability to pay bills directly through the platform.

While SCBK offers a solid digital banking platform, it lacks some of the versatile features that Co-op Bank provides, such as business solutions and extensive mobile access.

Why Co-op Bank is the Best Digital Bank in Kenya

Among all these digital banks, Co-op Bank shines through due to its broad range of services, user-friendly platforms, and unmatched security.

Here’s why Co-op Bank stands out.

Comprehensive Services: Co-op Bank offers more than just basic banking services. It provides an array of business banking solutions, e-commerce tools, and lending options that are crucial for both individuals and businesses.

Advanced Security: With robust security features like encryption and two-factor authentication, Co-op Bank ensures that your transactions are safe and secure at all times.

Customizable Solutions for Businesses: Co-op Bank provides businesses with specialized tools like trade finance, business loans, and e-commerce solutions to help them grow and thrive in the digital space.

Reliability and Trust: Co-op Bank has earned a reputation for reliability and customer-centric service. Its long-standing presence in Kenya’s banking industry further enhances its trustworthiness as a digital banking provider.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]