About 80 per cent of all social protection expenditure goes to the elderly in Kenya, who represent a paltry four per cent of the country’s population, locking out a huge chunk of the needy from the safety net, a World Bank survey has revealed.

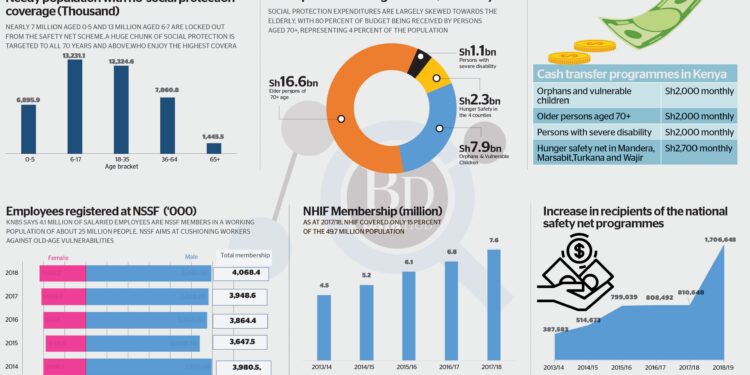

Nearly seven million needy children aged 0-5 years, and 13 million children six to 17 years old have no social protection coverage, the report says.

Similarly, some 12 million youth aged 18 to 35 years and eight million adults aged 36 to 64 years have no protection — raising questions on the effectiveness of the scheme targeted at promoting equity.

“Social protection expenditures are largely skewed towards the elderly, it would be important for the country to invest more in human capital in early years and in providing security and protection for the working-age,” it says.

Kenya has in recent years deepened its welfare programmes with the implementation of social protection schemes that sought to reduce exclusion and shield the elderly as well as the disabled from extreme poverty through monthly stipends of Sh2,000.

However, given that the cash transfer programme targeted all 70+ years, irrespective of their income status, the benefit-to-cost ratio is significantly low.

Up to 73 cents to every Kenya Shilling spent goes to the non-poor elderly, the World Bank study showed. Analysis of administrative data also shows that the elderly in less poor areas were more likely to take up this universal benefit.

“To better serve all of the poor in Kenya it would be important for social safety net programmes to improve the national coverage of the poor and not to focus just on the poorest counties,” the bank advises.

The World Bank study said increasing the coverage of families with children is of particular importance as children in Kenya are among the poorest across the age spectrum.

Some 37 per cent of children between the ages of 0-5 years live in families that are poor, it said, adding that in the 6-17 age group, 44 per cent live in poor households.

“The only cash-transfer programme that is targeted at poor children at the moment is reserved for orphaned and vulnerable children. There is no nationwide cash transfer programme that targets all poor children,” the report said.

“Overall social assistance covered just three per cent of children aged 0-5, and children aged 6-17, in 2015/16. Poverty during childhood can have long-term effects. Poorer children are more likely to have cognitive deficits, higher stunting levels, and lower levels of schooling, which can result in decreased welfare throughout their life,” it added.

In the 2015/16 fiscal year, there were 1,022,000 households in receipt of social assistance transfers in Kenya — constituting nine per cent of all households in the country. Out of this, 799,039 households, some seven per cent, received transfers through the National Safety Net Programmes (NSNP).

The NSNP houses four major cash transfer programmes: Cash Transfer for Orphans and Vulnerable Children, Older Persons Cash Transfer Programme, Persons with Severe Disability Cash Transfer and Hunger Safety Net (HSN) Programme.

Under the NSNP Kenya in 2019/20 fiscal year plans to release Sh7.9 billion for orphans and vulnerable children; Sh16.6 billion in cash transfer to elder persons; Sh1.1 billion to persons with severe disability. Hunger Safety Net Programme will get Sh2.3 billion.

Households in the northern and eastern Kenya receive proportionally more assistance with respect to their population size. Extremely poor households in the four counties in which the HSNP operates (Turkana, Marsabit, Wajir and Mandera) receives a monthly stipend of Sh2,700, thanks to highest poverty rates.

“Counties with the highest poverty rates are not necessarily the counties where most of the poor live,” the bank points out.

Nairobi has one of the lowest poverty rates. At the same time, due to the population size, the number of poor people in Nairobi is about 745,000. On the other hand, Mandera has one of the highest poverty rates in the country. However, because Mandera is smaller, the total number of poor in the county is about 554,000.

“Kenya can improve the equity of spending and efficiency of social safety net expenditures by improving the targeting performance,” says the bank.

The targeting performance of the large cash transfers can be improved by recertifying recipients, some of whom were selected 10 years ago with no re-evaluation of welfare since then.

Social protection in Kenya is implemented in three components of social assistance, social security and social health insurance.

Under social security, the government introduced National Social Security Fund (NSSF) in 1965 that was followed by National Hospital Insurance Fund (NHIF) in 1966 as part of a social health insurance scheme to cushion workers against future vulnerabilities.

Despite impressive expansion in membership, overall coverage remains low. The NSSF which covers salaried employees had 2.4 million active members in 2018, out of a working-age population of 25 million, of which 18 million are employed.

However, according to the Kenya National Bureau of Statistics (KNBS), the country has 4.1 million registered employees under the NSSF.

Although NHIF membership has increased to 7.7 million as in 2018, representing 15 per cent of Kenya’s 49.7 million population.

Social assistance covers only 6.8 per cent of the population, despite an overall poverty rate of 36.2 per cent.

“Such low coverage, as well as low adequacy of transfers (small transfer amount) translates to a low ability of social assistance in reducing the poverty rate in Kenya,” the report says.

Overall spending on social safety nets in Kenya has remained relatively stable, fluctuating between 0.4 to 0.6 per cent of GDP over the last decade. Although overall spending remained more or less constant, the spending on programmes has increased as a percentage of GDP, from 0.18 per cent in 2013/14 to 0.35 per cent in 2018/19.

But compared to its peers in the region, expenditure on the social safety net in Kenya is lower than other East African countries and much lower than countries in Southern Africa.

“Kenya spends less than countries such as Rwanda in Eastern Africa, and considerably less than countries such as Namibia, South Africa and Lesotho in Southern Africa,” the report says.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]