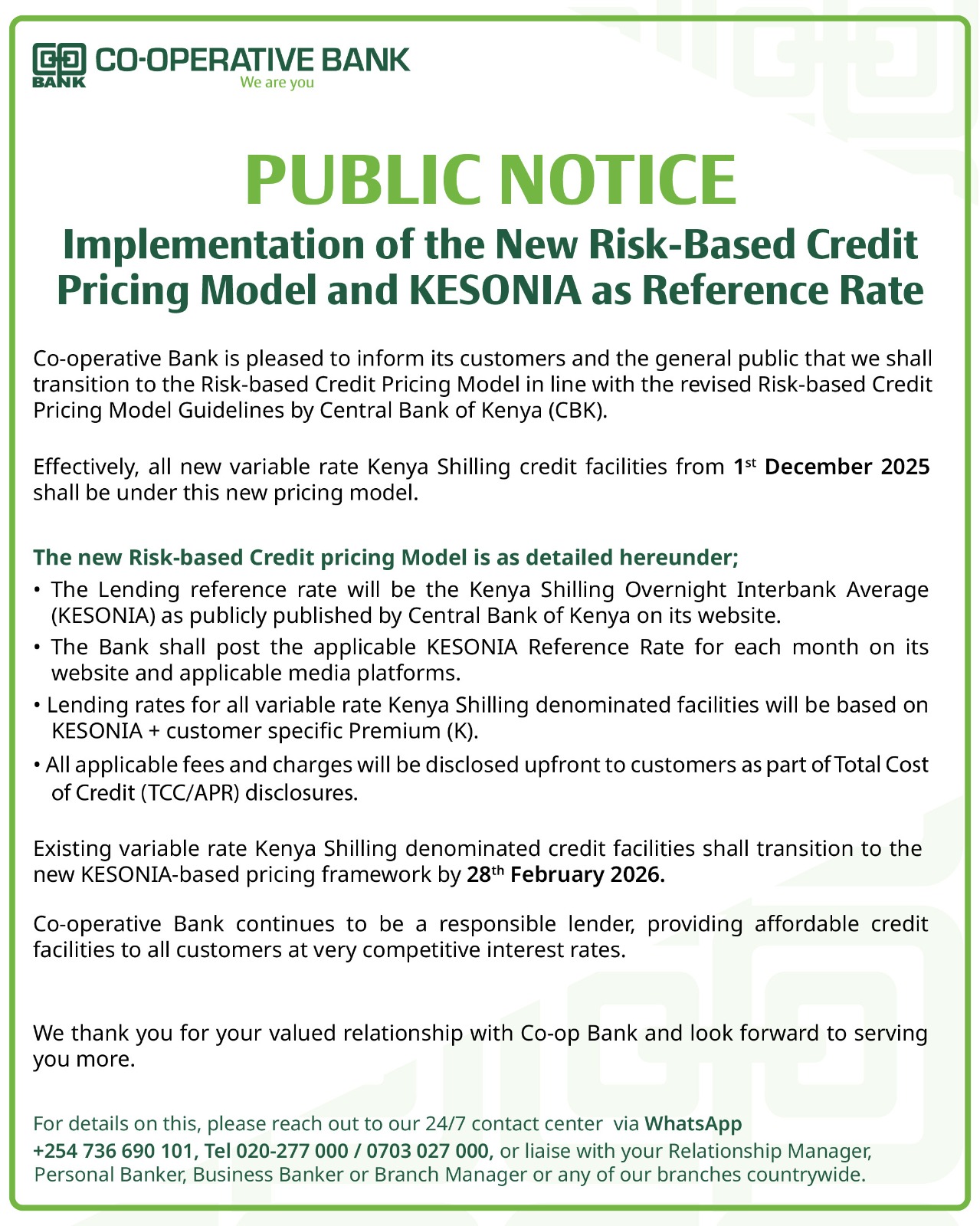

The transition of all new variable rate Kenya Shilling credit facilities to a Risk-based Credit Pricing Model using the Kenya Shilling Overnight Interbank Average (Kesonia) as the reference rate will take effect on December 1, 2025, with Co-operative Bank of Kenya implementing the framework in line with the revised guidelines issued by the Central Bank of Kenya (CBK), marking a strategic shift in how market-responsive lending rates are applied across the bank’s portfolio.

Under the new pricing model, lending rates will be determined as Kesonia plus a customer-specific premium that reflects the borrower’s risk profile, while all fees and charges will be disclosed upfront, ensuring that borrowers have full visibility of repayment obligations and the overall cost of credit over the life of the facility.

Co-op Bank confirmed that the applicable Kesonia reference rate for each month will be published on its website and through other media platforms, allowing individual, SME, and corporate clients to monitor interbank market fluctuations and understand how changes in short-term liquidity conditions may impact their borrowing costs, reinforcing transparency and supporting informed decision-making.

Existing variable rate KSh credit facilities will transition to the Kesonia-based framework by February 28, 2026, providing the bank and its clients with adequate time to adjust operational systems, align risk management procedures, and communicate the changes effectively, thereby minimizing disruption while integrating the market-driven benchmark into lending operations.

The decision to continue using Kesonia distinguishes Co-op Bank from most commercial banks, which have adopted the Central Bank Rate (CBR) as the benchmark for variable rate lending, citing operational simplicity and predictability.

By contrast, Co-op Bank maintains that Kesonia reflects real-time interbank market dynamics, short-term funding costs, and liquidity conditions, allowing for a more precise alignment between borrower risk and credit pricing.

Bank executives noted that the transition to Kesonia will enhance the capacity to implement risk-sensitive pricing, support operational efficiency, and maintain disciplined lending across individual, SME, and corporate portfolios, while continuing to offer competitive and affordable credit, positioning Co-op Bank strategically within Kenya’s evolving banking sector and responding effectively to macroeconomic trends and sector-specific credit demand.

Clients seeking guidance during the transition have been advised to contact the bank via its 24/7 contact centre, WhatsApp (+254 736 690 101), telephone (020-2770000 / 0703 027 000), personal bankers, business bankers, or any branch nationwide, reflecting Co-op Bank’s commitment to customer engagement, communication, and transparency while implementing a major operational change.

By adopting Kesonia as the lending benchmark, Co-op Bank reinforces its focus on market-responsive credit pricing, operational discipline, and risk-sensitive lending, supporting financial resilience, regulatory compliance with CBK guidelines, and sustainable growth across its lending portfolio, while maintaining its role as a responsible lender in Kenya.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]