[ad_1]

Ideas & Debate

CBK needs to get better ways of unlocking MSME lending

Thursday, May 23, 2019 20:09

By GEORGE BODO

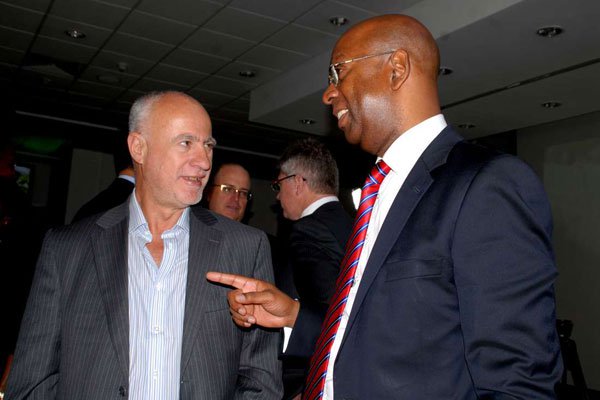

This week, the Governor of the Central Bank of Kenya (CBK), Dr Patrick Njoroge, led five commercial banks in launching the pilot phase of a mobile loan product targeting small firms.

The governor led the financiers in unveiling the initial phase of the initiative targeting micro, small- and medium-scale enterprises (MSMEs).

The product, dubbed Stawi, will initially be managed by five banks; Commercial Bank of Africa (CBA), the Cooperative Bank, Diamond Trust Bank (DTB), KCB and NIC Bank.

The loans will be accessible through a mobile phone application with limits ranging from Sh30,000 to Sh250,000 with repayment periods of between one and 12 months, at an interest of nine percent per annum.

Reading the CBK press release, it is evident that funding the economy, and especially the MSMEs, is top on everyone’s mind.

However, I could not help but wonder why the governor was commingling with the commercial side of policy and regulation. As a matter of fact, when it comes to unlocking funding, there are policy tools sitting at the disposal of the CBK that, in my assessment, only needs deployment.

For starters, the CBK can (and has the capacity to) establish a guarantee scheme for MSME funding. Such a plan can take the form of risk underwriting or direct funding to participating financial institutions for on-lending purposes.

In Nigeria, faced with a similar dilemma a couple of years back, the Central Bank of Nigeria established a Micro, Small and Medium Enterprises Development Fund.

Currently, 10 percent of the fund has been devoted to developmental objectives such a grants, capacity building and administrative costs while 90 percent commercial component is released to pre-selected participating financial institutions at two percent for on-lending to MSMEs at a maximum interest rate of nine percent per year. The apex bank even has a monitoring mechanism to ensure compliance.

Second, as a measure to disincentivise increased lending to national government by commercial banks (and the associated arbitrage activities) and spur funding of the real economy, the CBK can withdraw undisbursed deposits from the system by hiking cash reserve requirements for commercial banks. Any lowering of cash reserve requirements can only be based on them demonstrating a robust lending pipeline.

Otherwise it should not be business as usual. In 2018, commercial banks lent a staggering Sh140 billion to the government, while only advancing Sh90 billion to the real economy. This is a pittance and you just need to go backwards. In the period between 2010 and 2016 commercial banks, on average, lent Sh220 billion to the real economy annually, while annual lending to national government averaged at Sh68 billion in a similar period.

There’s another way to disincentivise this activity. The governor, in his fiscal advisory capacity to the Treasury, can choose not to be subdued by the Treasury’s fiscal aggression (which is the case currently), and in turn help lower the price at which the government sells domestic debt. Today, the government is borrowing long-term at close to 13 percent.

Why would any bank make risky lending at 13 percent? There is absolutely no incentive. Part of the problem is the lack of alignment between monetary policy and fiscal policy. The governor can make use of his policy position to help crowd in private sector and in the process help unlock funding to MSMEs.

While the Stawi initiative is quite noble, in my view, the governor can still do much more by opening his policy toolkit.

[ad_2]

Source link

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]