False investment claims circulating on social media have prompted fresh warnings to Kenyan consumers, as fraudsters impersonate M-Pesa and Safaricom brands to lure users with promises of extraordinary returns.

Safaricom has alerted the public to a surge of fake advertisements and messages that misuse its corporate identity, urging customers to rely only on official channels such as its website, the *334# menu, the M-Pesa App, or mySafaricom App for any financial or service-related information.

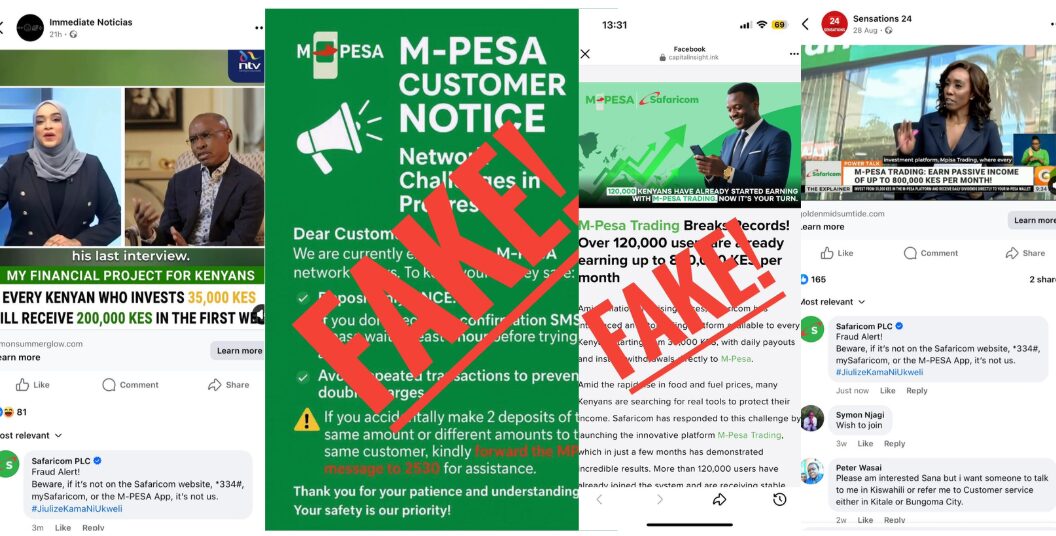

The fraudulent campaigns have promoted schemes such as “M-Pesa Trading,” falsely claiming that Kenyans who invest Ksh 35,000 could receive payouts of Ksh 200,000 within weeks, or that more than 120,000 users have already secured stable daily income through automated trading.

Screenshots and fake Facebook posts mimicking Safaricom’s style have been widely shared, creating a perception of legitimacy among unsuspecting users.

In an advisory shared across its verified accounts, the telco said it has not launched any such platform and has no connection to websites or social media pages promising high-yield returns.

“Beware, if it’s not on the Safaricom website, *334#, mySafaricom, or the M-Pesa App, it’s not us,” the company stated, urging Kenyans to verify any claims before sharing personal or financial details.

The company added that its fraud prevention teams are actively monitoring and reporting malicious sites and accounts to relevant authorities.

The scam wave reflects growing cybercrime risks in Kenya’s expanding digital economy, where mobile money platforms handle billions of shillings in transactions every day.

M-Pesa alone processed Ksh 35.9 trillion in value in the financial year ending March 2025, making it an attractive target for criminals seeking to exploit trust in the platform.

The Communications Authority of Kenya has separately reported an uptick in phishing and social engineering attempts aimed at mobile money users.

Analysts note that public awareness and digital literacy are critical for protecting consumers against such schemes, especially as online fraud becomes increasingly sophisticated.

Kenyan banks and telecom operators have in recent years intensified education campaigns on safe digital finance habits, warning against sharing PINs or sending money to unverified accounts.

For Safaricom, the incident underlines the reputational risks that come with being the country’s dominant mobile money operator.

The company has reiterated its commitment to customer safety and urged media outlets, influencers, and community leaders to help debunk misleading content.

By drawing clear boundaries between official communications and fraudulent claims, Safaricom aims to protect the integrity of M-Pesa as Kenya’s most widely used financial service.

Industry observers suggest that while technological safeguards such as multi-factor authentication and AI-driven fraud detection are essential, community-level vigilance remains equally important.

As scams evolve to mimic trusted brands more convincingly, public education and fast responses from corporations like Safaricom will remain vital to shielding Kenya’s digital economy from opportunistic criminal networks.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]