News

Kirubi payout from Bic sale rises to Sh1.8 billion

Thursday, June 6, 2019 10:21

By VICTOR JUMA

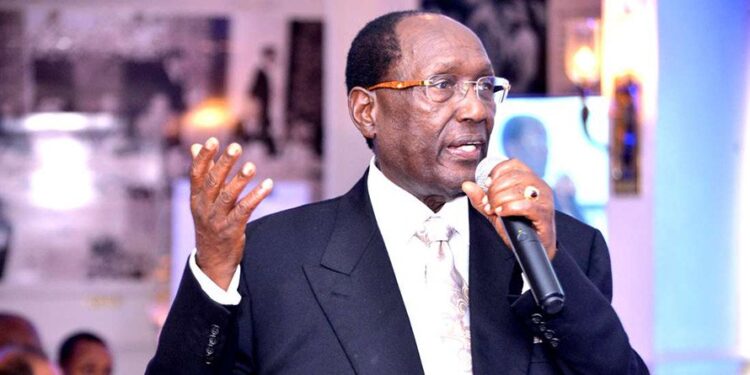

Billionaire businessman Chris Kirubi’s payout from the release of his BIC franchise to French conglomerate Société BIC is set to hit Sh1.8 billion after the multinational company indicated that it will make further payments to him over the next three years.

Société BIC has in new disclosures said that it will pay Mr Kirubi’s Haco Industries Kenya an extra €9.9 million (Sh1.1 billion), in addition to the initial €6.3 million (Sh718 million) payout announced earlier.

The transaction saw Haco Industries give up the exclusive rights to manufacture and sell BIC stationery, lighters and shavers in the region.

“At the end of 2018, the transfer of Haco Industries Kenya Ltd stationery manufacturing and distribution to BIC was completed and 6.3 million euros were paid. 9.9 million expected to be paid during the coming three years,” the multinational says in its latest annual report.

Mr Kirubi’s profit in the deal stands at Sh611 million, representing the premium on the value of assets transferred to the French multinational.

The businessman told the Business Daily that the deferred payment is due to the capital commitments Haco had already made in the BIC business by the time the transaction was completed on December 31, 2018.

Société BIC took over manufacturing facilities in Kenya and distribution of stationery, lighters and shavers in East Africa, with Haco retaining ownership of the properties that it has leased out to the French firm.

“The deferred payment will compensate Haco for its investment in BIC including inventory and raw materials being imported,” said Mr Kirubi.

The French multinational said it inherited BIC inventory with a gross value of €2.8 million (Sh329 million) and supplier debt of €9.9 million (Sh1.1 billion), resulting in short-term liabilities exceeding current assets by €7 million (Sh802 million).

Despite this, Mr Kirubi priced the deal to emerge with the Sh611 million profit, which is booked as goodwill by the French company.

“A preliminary goodwill recognised for Sh611 million (€5.5 million at the date of the transaction) was determined based on the fair value of net assets of Haco at the acquisition date. This amount is provisional as of December 31, 2018,” Société BIC said.

Sale of the BIC division means that Haco is now left to trade in the home care and hair care line of businesses whose brands include Sosoft fabric softener and Miadi shampoo.

Haco had been manufacturing and distributing the BIC brand of products for 40 years before it relinquished the business to the French firm.

The multinational says it implemented a restructuring at Haco following the acquisition, a move that contributed to a reorganisation cost of €15.4 million (Sh1.7 billion) at the parent company level.

It is not clear how many Haco employees were affected by the restructuring.

“In the event of staff restructuring that results in job cuts and terminations of profiles that are not adapted to the futures organisations, group policy is to respect local legal obligations as a minimum, in co-operation with social partners,” said Société BIC.

“Moreover, BIC strives to re-assign employees whenever possible.”

The multinational acquired Haco’s semi-automated production plant located in Kasarani as part of the transaction, which the Kenyan firm said would give it an opportunity to diversify and grow in the regional markets.

Haco’s revenues are set to decline on the back of the BIC divestiture, with the French multinational’s products estimated to have been the most valuable for the Kenyan firm in terms of sales.

The deal adds to the emerging trend in retail and fast-moving consumer goods sector, where multinationals have squeezed out local franchises by buying them out or entering into joint ventures with them.

Such moves have been attributed to the desire by the multinationals to take a bigger chunk of profits as well as enforce standards, including pricing, marketing and customer service.

BIC says the transaction is in line with its continued growth strategy in Africa, with the multinational projecting a positive growth for the stationery market.

“This acquisition is in line with BIC’s continued growth strategy in Africa, one of the most promising markets for BIC products in the world,” the multinational says in the report.

Sales of BIC pens have been helped by a widely recognisable brand and strong relationships with large customers, including companies that order customised units.

Société BIC has set several targets to be achieved by 2022 including annual savings of €20 million (Sh2.2 billion) and hitting 10 percent of net sales through e-commerce.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]