[ad_1]

– Koech proposed that Credit Reference Bureau Regulations be repealed to stop lenders from sharing information of borrowers

– The MP suggested the lenders should resort to the conventional means of recovering their loans without sharing borrowers’ information with non-parties

– He argued the practice of sharing borrowers’ information with listing claims of as low as KSh 100 stifled growth of enterprising youth

– More than 500,000 defaulters, majority of whom are youth, are blacklisted on the CRB according to Financial Study Deepening (FSD)

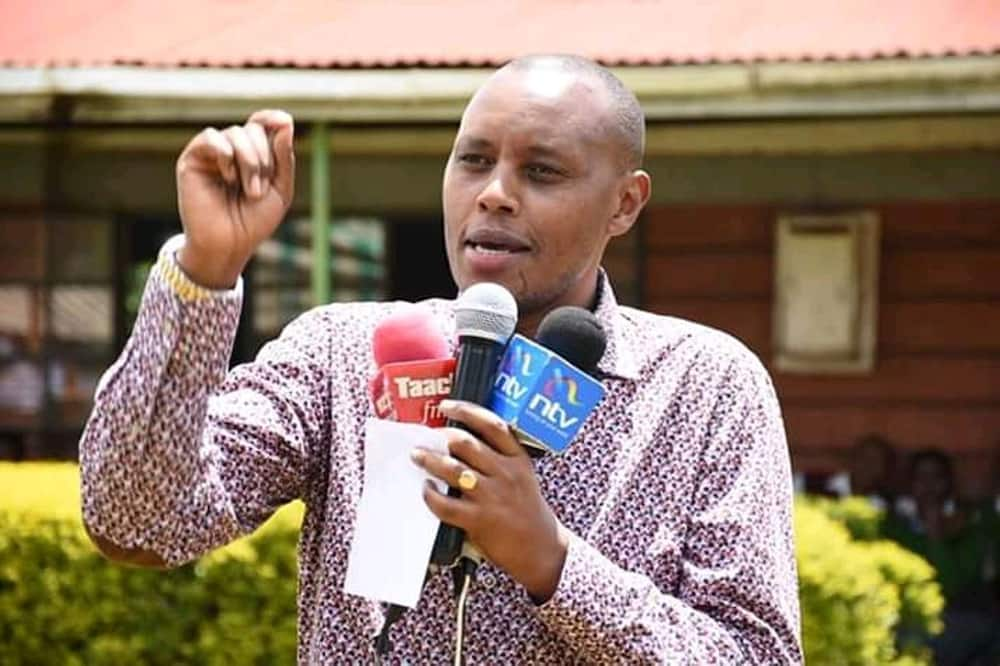

Belgut Member of Parliament (MP) Nelson Koech has proposed for amendment of the Credit Reference Bureau Regulations 2013.

Koech’s proposed amendment is seeking to stop the local lending institutions from sharing information of borrowers with non-parties in efforts to recover their debts.

READ ALSO: Credit Reference Bureau to expunge names of youth from list of loan defaulters

Belgut Member of Parliament Nelson Koech is seeking to table a bill seeking to stop the government from blacklisting on the CRB defaulters of less than KSh 100. Photo: Nelson Koech.

Source: Facebook

READ ALSO: Utafiti: Wakenya wazidi kupoteza imani, 77% wanaamini serikali ya Jubilee haitatoboa

In a letter dated May 21, 2019, addressed to the Speaker of the National Assembly Justin Muturi, the legislator proposed the lenders should revert to the conventional ways of recovering debts without sharing borrowers’ information.

The MP’s main concern was that listing of loan defaulters on the CRB was stifling growth, especially among the youth.

“The practice of sharing borrowers’ information with listing claims of as low as KSh 100 has denied growth to the enterprising youth,” Koech argued.

READ ALSO: Over 400k Kenyans blacklisted on CRB over loans of less than KSh 200

His motion seeks to repeal Sections 31 (3) and 4 and 55 (1) of the Banking Act and Sections 34 (4) and 5 and 48 (2) of the Microfinance Act 2006.

A 2018 report by Financial Study Deepening (FSD) indicate more than 500,000 loan defaulters, majority of whom are youth aged between 18 and 25, are blacklisted on the dreaded CRB and are therefore unable to access bank loans.

READ ALSO: Government to suspend licences of all betting firms in the country from July 1

The government had cited betting as a major contributing factor to the skyrocketing number of young people who are borrowing loans to bet and then failing to settle their debts.

Do you have a life-changing story you would like us to publish? Please reach us through [email protected] or WhatsApp: 0732482690 and Telegram: Tuko news.

Why Kenyan men are depressed – On Tuko TV

Source: Tuko Newspaper

[ad_2]

Source link

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]