Health & Fitness

Explore Esops to retain talent in health sector

Tuesday, June 11, 2019 19:22

By EDWARD OMETE

With many private hospitals now moving into the expansion phase, a few find themselves in a transition from the first generation owners to a second generation ownership.

Within this course of time, some have grown significantly both in terms of revenue and by extension, staff numbers.

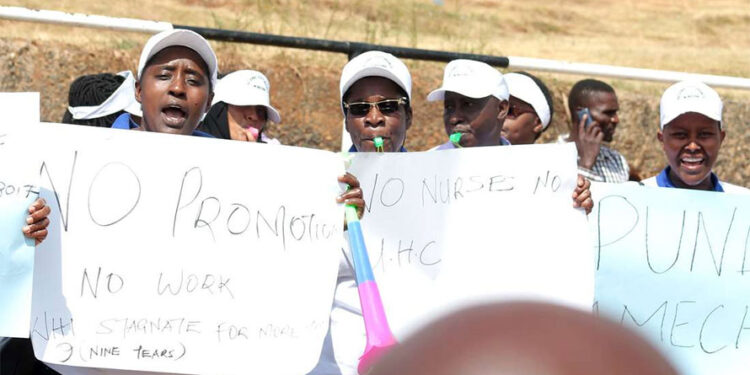

For such entities, especially in the healthcare industry, which has amongst the highest employee turnover rates, how to retain skilled and critical staff becomes a key concern. The same applies to rewarding long- serving staff.

Hospital managements and administrators are grappling with a ballooning wage bill not in tandem with the hospitals’ expenditure, particularly during the growth phase where revenue and expenses are closely matched. In a survey amongst most hospitals in the tier 3 and 4 segment, higher salaries becomes one of the commonest reasons for staff exits.

Typically, hospitals in such a phase see their staff under-earning compared to their peers as well as logging in slightly longer staff. Amongst nursing cadres, variance between Sh30,000 in the smaller facilities and Sh60,000 in the larger ones creates a reason for “job change.”

For those in the early phases of establishing themselves, retaining top and quality talent amidst serious cash flow constraints is always difficult.

One approach to consider is Employee Stock Ownership Plans or Esops. The financial sector has already shown this model works and locally Equity Bank’s Esop is arguably one of the most visible ones. Several other banks have also followed suit.

The benefits include gaining employee buy-in as well as managing wages and remuneration in times of constrained finances for the employer. Their lock-in period barring trading for a certain period also creates a “caution source” in case employees need to in any particular way be held accountable to the employer cash wise.

There is a danger though to the employees on such an arrangement. Because Esops essentially are a form of deferred earnings and ride on the hopes of continued growth and positive performance of the entity, if this does not happen then employees stand to lose.

Troubled cement manufacturer Athi River Mining, which had also exercised Esops in its previous growth and expansion strategy, created high returns for its employees through such an arrangement. The sad turn of events of the cement sector and the business now leaves employees with stock in dwindled returns.

At the fore though, Esops provide an opportunity to hold the management and leadership to account in the interest of the facility because employees also become owners.

But whether ESOPS use by founders to appreciate sacrifices that employees who sign-up to the company’s vision and struggles to inspire loyalty and longevity of stay is questionable. That said, health enterprises need to evaluate its applicability in our sector and suitability in the current context of strained financing in a growing health industry.

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]