By Graham A.N. Wright- Group Managing Director, MicroSave Consulting.

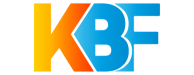

Many commentators have raised concerns about the interest rates charged for digital credit. And, given that the entire process is automated and dependent on computer algorithms rather than expensive human intervention and analysis, this seems reasonable. On the face of it, it is strange that the interest rates charged for digital credit should be closer to those common in the informal sector than those charged for other formal sector loans. So what is going on?

There are three key drivers of the high interest rates: 1. The small size of loans; 2. The cost of data analytics; and 3. The risk premium priced in.

- Small Loans: We all know that, broadly-speaking, it costs the same amount of money to make a $10 or a $10,000 loan. Digital credit loans, absent the personal relationship, start by lending small amounts (typically $10-20) to gauge repayment behaviours and base future lending decisions (largely) on the basis of these. The interest on these minimal amounts is often inadequate to cover even the variable costs associated with making a digital loan (SMSs or data charges etc.).

- Data Analytics: Digital credit providers not only need to invest significant amounts upfront to build their platforms and algorithms, but also on an on-going basis to keep refining them as they learn through the behaviour of their customers. One large provider tells us that they are spending $200-300,000 per month on analysts to maintain and develop their system.

- Risk Premium: MicroSave’s recent analysis of a credit reference bureau’s data has highlighted the extraordinarily high default rates amongst digital credit borrowers in Kenya, where the best data is available. We can safely assume that this is a pervasive problem. Inevitably, providers of digital credit have to price these losses into the interest rates charged for loans. This means that all borrowers (whether they repay on a timely basis or not) have to pay the risk premium for those that default.

While providers of digital credit will always struggle with the mathematics and economics of small loans and the cost of data analytics, there is clear opportunity to reduce the level of defaults and thus the risk premium that has to be charged … and perhaps that smart algorithms alone will not be enough to do so.

CGAP’s Greg Chen highlights six early errors made by digital credit pilots and deployments. Several of these contribute to the high levels of default.

- Offering credit without a strong remote identification system. When you can’t verify customer identity, offering remote services is difficult, especially at scale.

- Poor targeting, where credit offerings attract a high-risk applicant pool.

- Cumbersome loan application processes so that only those higher risk borrowers, who are unable to secure credit from other sources, apply.

- Poor product design, which does not adequate recognise and reward those that do repay regularly and on time.

- An excessive focus on credit scoring but the absence of a sound collections strategy.

- Credit scoring models that were too conservative and did not allow credit to be extended to more than a small fraction of applicants.

Addressing 1. – 5. could allow providers of digital credit to improve targeting, increase loyalty and reduce both risk and default … thus increasing the profitability of providers of digital credit.

1. Identification systems: A growing number of countries are introducing formal identification systems – many of which are bio-metrically enabled. And, even where no such systems are available, app-based ID systems (including for example Yoti, Taqanu, Trulio) are increasingly common. These, of course, require smart phones, but the growing penetration of smartphones continues despite some set-backs with low cost smart phones. Digital credit providers will need to leverage these ID systems to have a firm fix on their customers – this will be key to identification, credit assessment, collection and delinquency management. ID will also be key to running effective credit bureaus. Unfortunately, few countries outside Kenya have credit reference bureaus designed to help with the management of the small loans offered by digital credit … and thus to allow people to develop a credit history. While Kenya’s credit reference bureau is still finding its feet, it is playing an immensely important role in creating transparency and allowing those who do repay on time to create a positive records.

2. Poor targeting: Getting the right balance between credit scoring models that are too conservative and those that are too liberal is key to building an effective system. But there are other drivers of poor targeting. Digital credit lenders will also need to achieve the right balance between aggressive “push” marketing and ensuring that their product is properly understood in the market. As we have seen, too many people respond to push marketing by borrowing out of curiosity, and without any real need or purpose in mind. Providers can clarify their marketing to give customers a better understanding of their terms and conditions, as well as the penalties for non-repayment. This approach would also allow them to address challenges with consumer protection. They can also use behavioural nudges to facilitate appropriate behaviour.

Mobile network operators (MNOs) can also reduce targeting risk by completing initial credit screening through lending airtime credit. Airtime has marginal costs for an MNO, and thus represents a much lower risk than e-value credit. Thus this approach could allow MNOs to test borrower’s credit behaviour at much lower cost before opening a window to borrowing e-value.

3. Loan application processes: Many SMS-based and USSD-based digital credit systems make it almost too easy to access credit, thus potentially encouraging frivolous applications for credit. This, may need management through behavioural nudges – for example to encourage the potential borrower to view the terms and conditions, or to reaffirm the need for the loan after a nominal “cooling off” period. In contrast most app-based systems require the user to go through many screens (and, in some cases, what are seen as invasive requests for data and photographs) before they are given their loan. These systems need a thorough review to ensure that each step in the process is optimised, really adds value and does not put off high potential borrowers.

4. Poor product design: Currently, few of the digital credit products available reward those that consistently repay on a timely basis – except by offering larger loans. As borrowers demonstrate their credit-worthiness it would make sense to reduce the risk premium (and thus the interest rate) that they have to pay for each successive loan. This approach might be further reinforced and optimally communicated by creating a tiered status system (similar to those for airline miles) so that borrowers can aspire to move up the tiers and thus qualify for lower interest rates, larger loans, variable repayment periods and other benefits. Additional product innovation might include: 1. Loans with a tenure of a day for market traders who are currently having to use loans repayable over weeks or a month to finance their business cycles, which run from early morning to afternoon; 2. Goal-based savings/loan products with an appropriate financial planning tool embedded in the app or USSD interface; 3. Longer-term loans for those with an excellent credit record who want to borrow for their business – once again these need to reflect their business cycles.

5. Absence of a sound collections strategy: At present most digital credit providers use SMS to encourage repayment, but otherwise have little interaction with their borrowers. Only a few are using call centres to talk to borrowers struggling to repay. The important human touch is missing, and thus digital credit loans are last on the list to repay amongst households with multiple loans outstanding. For larger loans it may also be valuable to involve agents in both loan origination and repayment/delinquency management.

Readers will note that none of the above refers to using “big data” – in a way that has been so successfully done in the developed world (for example by Lending Club in the US). This is because the vast majority of low income people in the developing world do not leave adequately deep “digital footprints” to reliably inform credit decisions. This will change over time, but for now the most effective (and commonly used) indicators of credit worthiness lie in credit history and behaviour, and (to a lesser extent) top-up and call/SMS behaviour. It maybe that for larger loans app-based providers of digital credit may also want to use psychometric indictors to assess willingness to pay. However, this would be dependent on reducing the typical screening questionnaire from 200-300 down to 40-50 questions without losing predictive capability – quite a challenge.

There is a clear need to reduce the risk premium for borrowers of digital credit. While this may be difficult (but by no means impossible) to do for the first couple of loan cycles, it should be eminently feasible for later loans cycles once the borrower has established credit history and wants to borrow larger amounts. Doing so should incentivise timely repayment and increase borrower loyalty … and thus profitability of the providers of digital credit

Kenyan Business Feed is the top Kenyan Business Blog. We share news from Kenya and across the region. To contact us with any alert, please email us to [email protected]